How Much Money Did Bestbuy Make From Issuing More Stocks History

Scott Olson/Getty Images News

Lift Pitch

I assign a Bullish or Buy rating to Best Purchase Co., Inc. (NYSE:BBY).

The market place appeared to be dissatisfied with Best Buy's recent quarterly results equally evidenced by its share cost autumn on November 23, 2021. But the -12% stock price correction seemed to have been also harsh, and I think that investors should consider the company's Totaltech membership plan equally a cardinal intermediate-term re-rating catalyst for its shares. Considering Best Buy's highly-seasoned depression-teens forward P/E valuations, I rate Best Purchase'due south shares as a Buy.

Best Buy Earnings

Best Purchase, which calls itself "the world's largest consumer electronics retailer" on its corporate website, announced the company's financial results for the 3rd quarter of financial 2022 (YE January) on November 23, 2021, before trading hours.

The company's Q3 earnings printing release was issued with the championship "Best Buy Reports Better-Than-Expected Third Quarter Results", and that was correct. BBY's not-GAAP adapted earnings per share of $two.08 was +6% higher than what the sell-side analysts had expected. Merely this paled in dissimilarity with Best Purchase'south +58% earnings trounce for both Q1 FY 2022 and Q2 FY 2022.

More chiefly, investors didn't seem to be pleased with Best Buy's financial performance in the recent quarter. BBY's shares dropped by -12% from $138.00 every bit of November 22, 2021, to $121.01 as of Nov 23, 2021.

In my opinion, the market'south negative reaction to Best Buy's Q3 FY 2022 financial results seems overdone. I think that at that place are two key positive takeaways from BBY'due south contempo third-quarter results which accept not been given sufficient credit.

Firstly, Best Buy achieved a positive +2.0% YoY growth for the company'due south domestic comparable sales in Q3 FY 2022, despite a high base in Q3 FY 2022 which saw a +22.6% YoY jump in domestic comparable sales.

In other words, concerns that All-time Buy's sales will drop significantly, as need for consumer electronics normalizes with the reopening of the economy, seem to be overblown.

Secondly, supply chain constraints and bottlenecks are not impacting BBY in a significant way equally earlier feared. Best Buy disclosed at its Q3 FY 2022 results briefing that its inventories as of end of the recent quarter were +15% and +13% college as compared to ane year and two years ago.

Having aplenty inventories to meet holiday need is a primal factor influencing my short-term outlook for All-time Purchase, which I detail in the subsequent section.

What Is The Outlook For Best Buy Stock?

I accept a positive outlook for Best Buy stock in both the most-term and the medium-term.

As per the visitor's Q3 FY 2022 earnings printing release, BBY expects its comparable sales growth to be in the -2.0% to +i.0% range for the final quarter of the current fiscal twelvemonth. This implies that Best Purchase does non see a fabric sales growth deceleration in Q4 FY 2022 similar to the 3rd quarter, which is a positive. Best Purchase also mentioned at its recent quarterly earnings telephone call that the Q4 sales guidance "is slightly upwards from the implied guidance range from last quarter."

Jefferies (JEF) published a sell-side research study (not publicly bachelor) titled "Domicile For The Holidays? Consumer Holiday Spend Intentions Survey" on November 17, 2021, detailing results of a "~1,200 consumer survey regarding holiday spend intentions" In the written report, it was highlighted that "more consumers plan to increase spending at Bestbuy.com this holiday season (14%) vs. subtract (13%)" and noted that "28% of the ~ane,200 consumers surveyed are planning a visit to their (Best Buy'southward) stores."

The results of the survey conducted by Jefferies seem to be aligned with All-time Buy's management comments. At its third-quarter results telephone call, BBY stressed that it is "confident about our inventory levels and our positioning for the holiday", and observed that it was "encouraged by the holiday demand that the consumer is very strong still."

In summary, I think information technology is highly likely that Best Purchase will be able to meet market expectations in Q4 FY 2022 at the very least, based on what I have highlighted to a higher place.

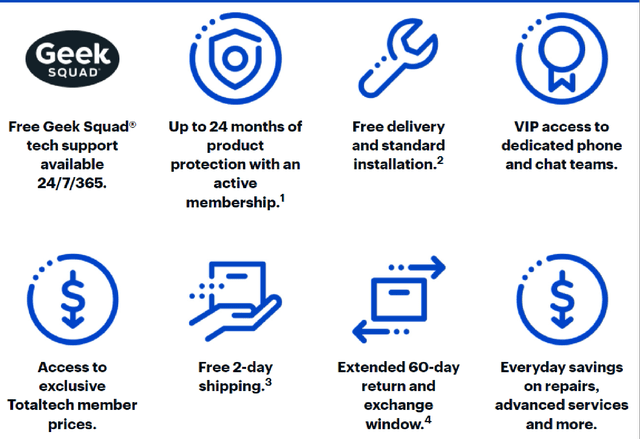

Moving beyond the holiday season and the 4th-quarter expectations, BBY's new Totaltech membership program is the central growth driver for the company in the intermediate-term. The Totaltech membership programme, which is priced at $199.99 per year, was outset introduced in specific stores & markets in April 2021, before information technology was launched across the state in October 2021.

Fundamental Features Of The Best Buy Totaltech Membership Program

Source: BBY'south Totaltech Membership Website

Source: BBY'south Totaltech Membership Website

At the company's Q2 FY 2022 investor results phone call in late-August 2021, All-time Buy revealed that the members of its new Totaltech programme pilot in April "have a higher incremental spend than nonmembers" and "are skewing younger."

Notably, the sell-side analysts have raised their earnings per share forecasts for Best Buy in fiscal 2022, 2023, & 2024 by +21%, +12%, and +eighteen% in the past 6 months, respectively, which coincided with the introduction of the Totaltech membership program pilot. An analyst from Piper Sandler besides expects All-time Buy's Totaltech members to double or triple from the current iii meg base in time to come, according to an October 5, 2021, CNBC news article.

I expect Best Buy to be able to sustain a loftier unmarried-digit earnings CAGR in the mid-term, considering the positive outlook for Totaltech membership plan in terms of membership growth and increased spending per client with a rising percentage of members as a proportion of full customers.

Is BBY Stock A Buy, Sell, Or Hold?

I have a Buy rating on BBY stock that is premised on its undemanding valuations, besides as its growth outlook outlined in the preceding section.

The marketplace currently values Best Buy at 12.i times consensus forward fiscal 2022 normalized P/East and 12.vii times forwards FY 2023 normalized P/E, as per S&P Capital IQ data. This seems bonny compared to my expectations of a high single-digit earnings CAGR for Best Purchase in the medium term, and BBY'southward consensus forward FY 2022 and FY 2023 Render on Avails or ROAs of thirteen.8% and 12.8%, respectively.

Also, All-time Buy is trading below its historical average valuations. Co-ordinate to S&P Capital IQ data, BBY'southward five-yr mean consensus forward next twelve months' normalized P/E multiple was approximately 14 times.

All-time Buy's valuations are appealing, and I think that the future success of its Totaltech membership program can act as a catalyst to re-rate its valuations. As such, I decide to assign a Bullish or Buy investment rating to Best Buy.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap betwixt price and intrinsic value, leaning towards deep value residuum sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and broad moat stocks (i.east. buying earnings ability at a discount in great companies like "Magic Formula" stocks, loftier-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Source: https://seekingalpha.com/article/4471831-best-buy-stock-earnings

Posted by: thomashimageary.blogspot.com

0 Response to "How Much Money Did Bestbuy Make From Issuing More Stocks History"

Post a Comment